straight life policy term

A life insurance policy that provides coverage only for a certain period of time. Term life insurance covers you for a specific number of years usually 10 20 or 30 years while whole life insurance covers you for life as long as you keep up with your premiums.

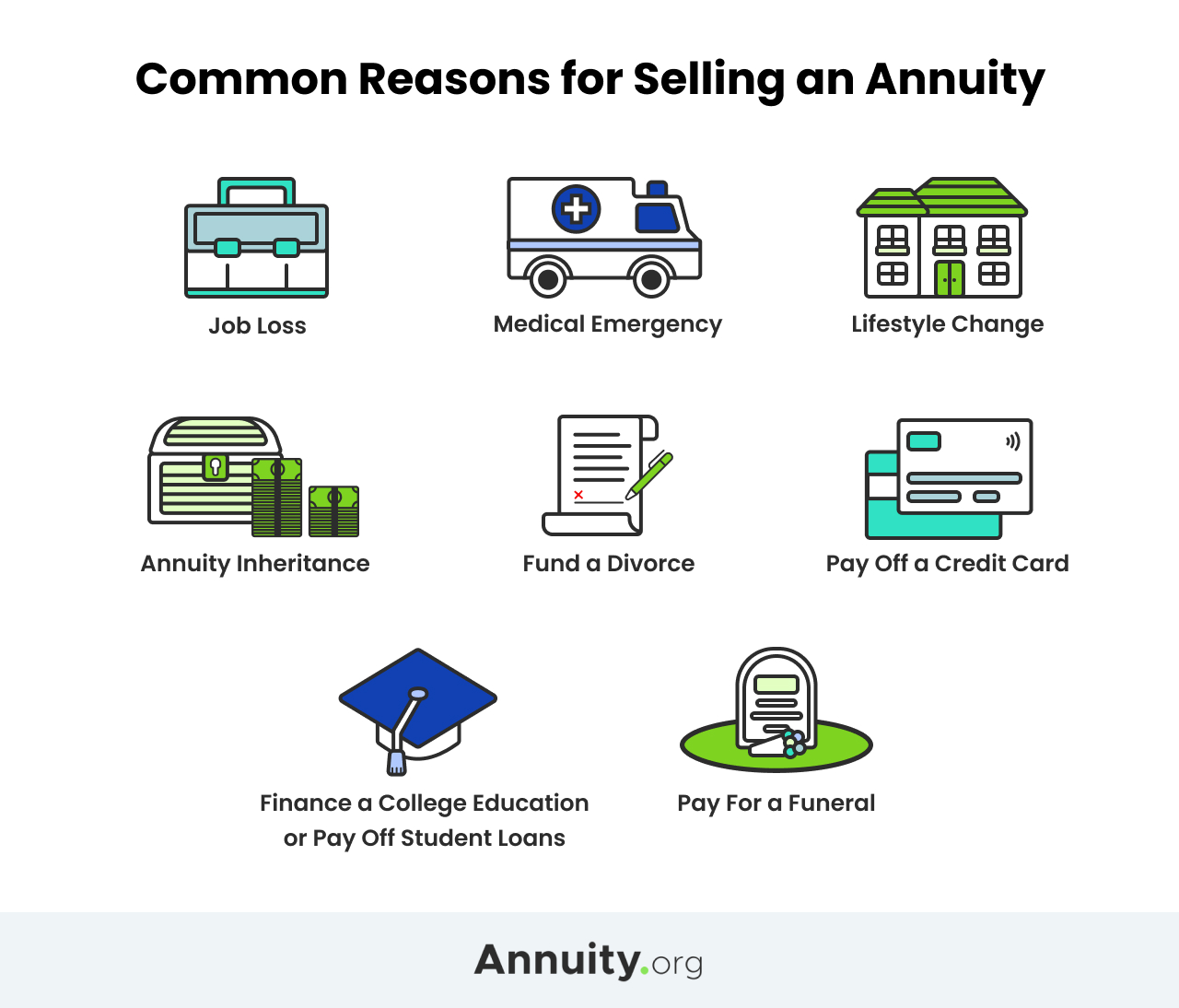

When Can You Cash Out An Annuity Getting Money From An Annuity

Most term life insurance policies offer a level death benefit and premiums.

. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. Which of the following is an example of limited pay life policy A Level Term Life B. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death.

For most people this is preferable as you have the coverage while you need it most. Term to specified age B. Life Paid-up at Age 65 D.

Sets with similar terms. However 20-year limited pay life policies are designed so that the premiums for coverage will be completely paid for in 20 years. Ad Rates starting at 11 a month.

Limited pay whole life D. What is Straight life. This guide will discuss what straight life insurance is and how it works.

Straight Term Insurance Policy. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100. There are no outstanding loans on the policy what portion of the death.

Straight term insurance policy. A whole life policy in which premiums are payable as long as the insured lives. Life Paid-up at Age 65.

While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. What is the purpose of establishing the target premium of a universal life policy. What Does Whole Life Insurance Mean.

What is a Straight Life Policy. A father who dies within 3 years after purchasing a life insurance policy on his infant daughter can have the policy premiums waived under which provision. Like other forms of whole life insurance the death benefit of a straight life policy is guaranteed to remain in place for life if premiums are paid.

Life Paid-Up at Age 70. Term life insurance policy providing a fixed-amount death benefit over a certain number of years. Premium payments are level.

Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy. For example a 30-year-old male who is a non-smoker might pay a premium of 25 per month throughout the life of a 15-year 200000 decreasing term policy. A straight life policy has what type of premium.

They wont go up regardless of age or health. A term policy is designed for short-term needs. If the owner of a whole life policy the insured dies at age 80 and.

Continuously premium straight life policies are designed so that the premiums for coverage will be completely paid for by the insureds age of 100. Straight life insurance is a type of whole life insurance. Straight Life Policy an ordinary life policy or whole life policy.

See your rate and apply now. An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a.

As with all whole life insurance contracts at age 100 the policy cash value. If the owner of a whole life policy the insured dies at age 80 and. This type of policy can be used as an estate planning tool or to provide financial security for loved ones.

A decreasing annual premium for the life of the insured. It pays out a death benefit upon the policyholders death and it accumulates cash value over time that the policyholder may withdraw for personal use or borrow against. Like all annuities one may buy the plan with a lump sum or with a series of payments over a number of years usually ending around retirement.

Example of a Decreasing Term Policy. USAA policyholders can convert the term life policy to a permanent policy up to the last day of the level term period. At one time the cash value exceeded 100000 and was worth 150000.

After death however the payments cease and the policyholder does not name a beneficiary. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death. Upon expiration the policyholder may decide to renew the policy or allow it to lapse.

Whole life insurance policies mature when the insured reaches the age of. Life Insurance Policies QA. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide this benefit if heshe is still alive when the policy expires.

An insured has a variable life policy with a 100000 face amount. Renewable Term to Age 70. An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

Help protect your loved ones with valuable term coverage up to 100000. Ordinary life policy C. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a.

To prevent the policy from lapsing.

How You Can Increase Your Insurance Sales With This 8 Tips Insurance Sales Life Insurance Sales Term Life Insurance Quotes

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

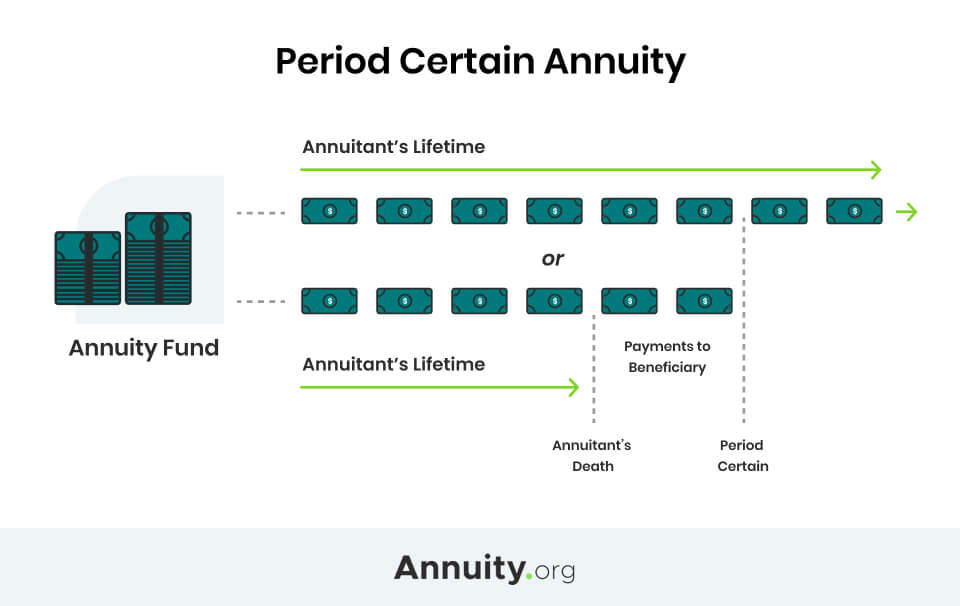

Period Certain Annuity What It Is Benefits And Drawbacks

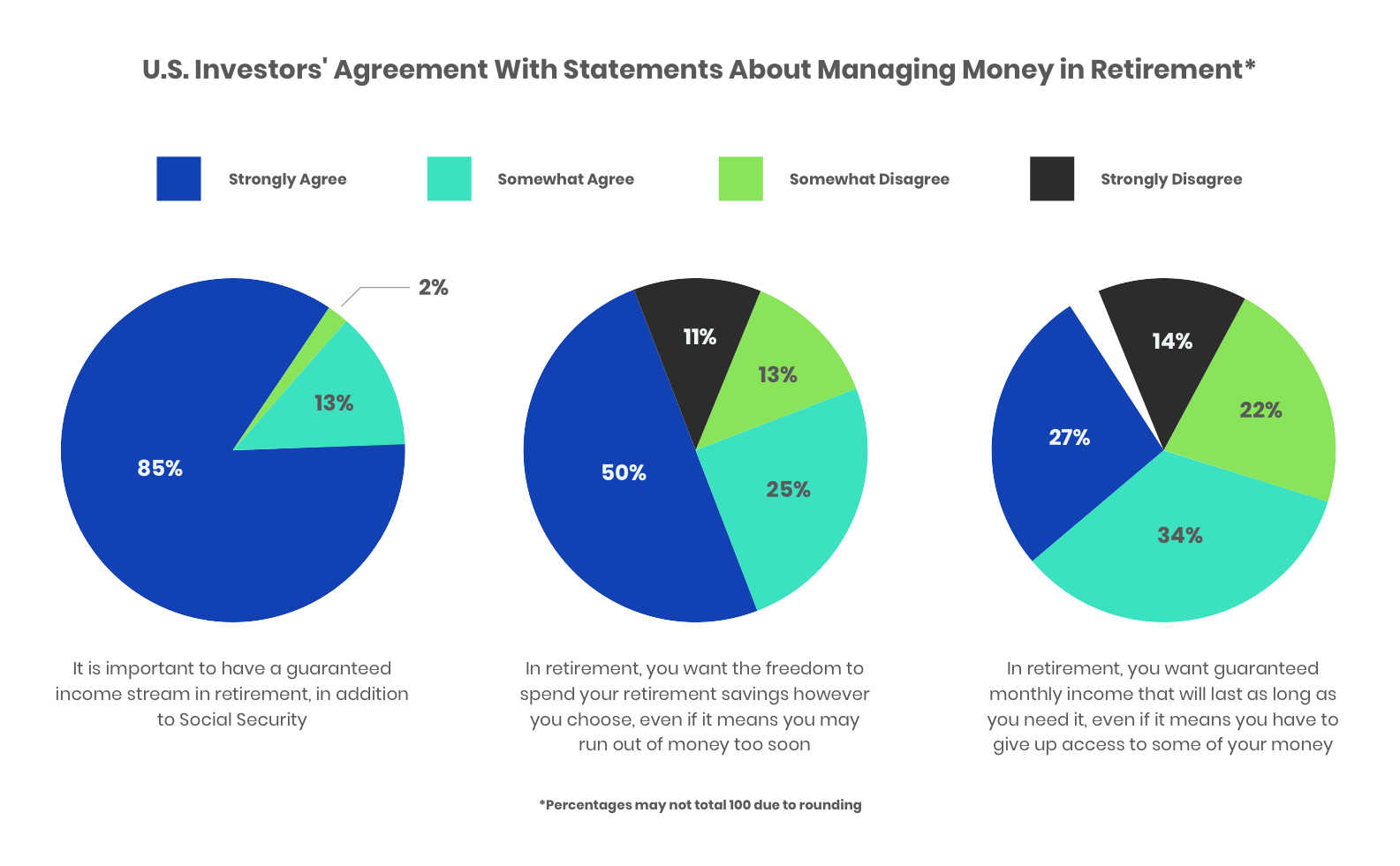

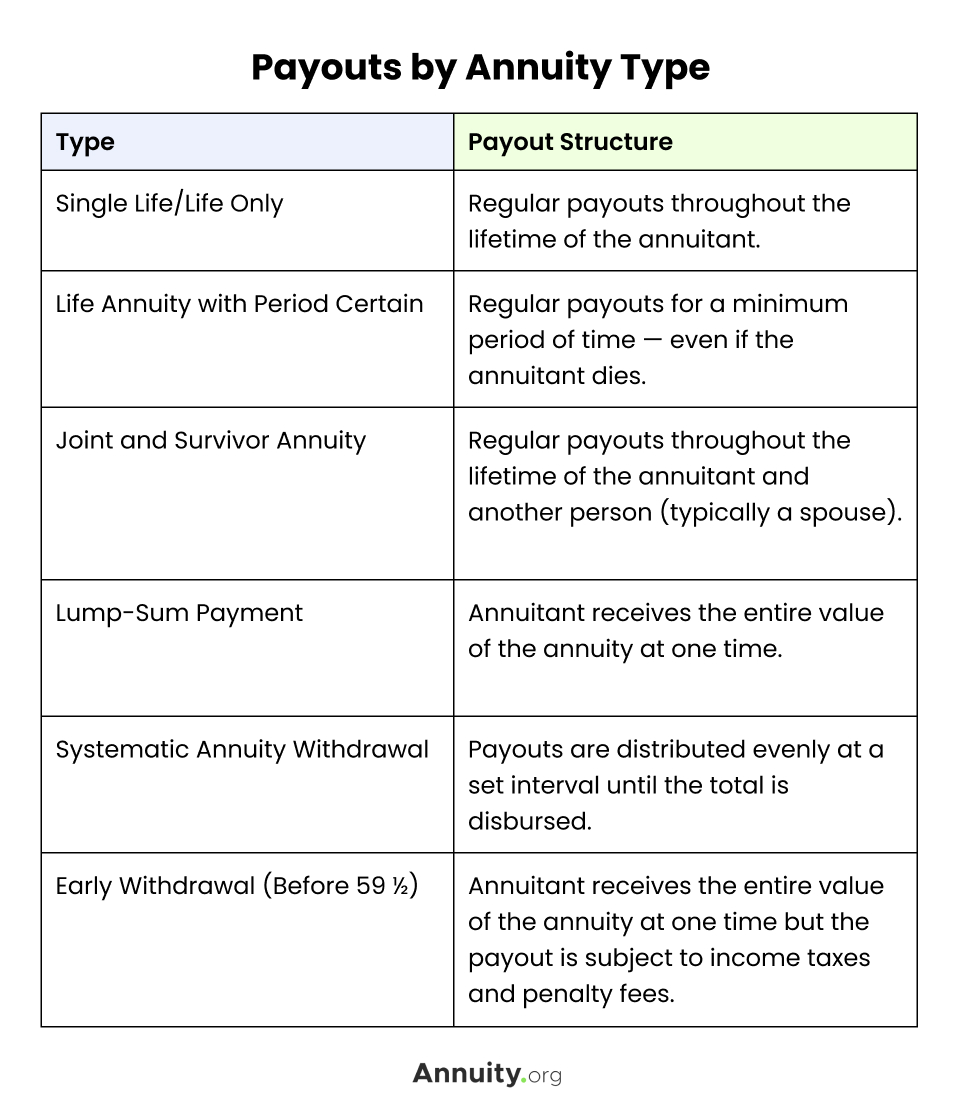

Annuity Payout Options Immediate Vs Deferred Annuities

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

How Much Are Life Insurance Quotes Life Insurance Facts Life Insurance Quotes Whole Life Insurance

5 Reasons Why Buying Life Insurance In Your 30s Is A Good Idea Life Insurance Life Insurance Companies Insurance

The Cost Of Life Insurance Depends On Many Different Factors On A Person S Profile Because The Ins Life Insurance Facts Life Insurance Marketing Life Insurance

What Is Straight Life Insurance Valuepenguin

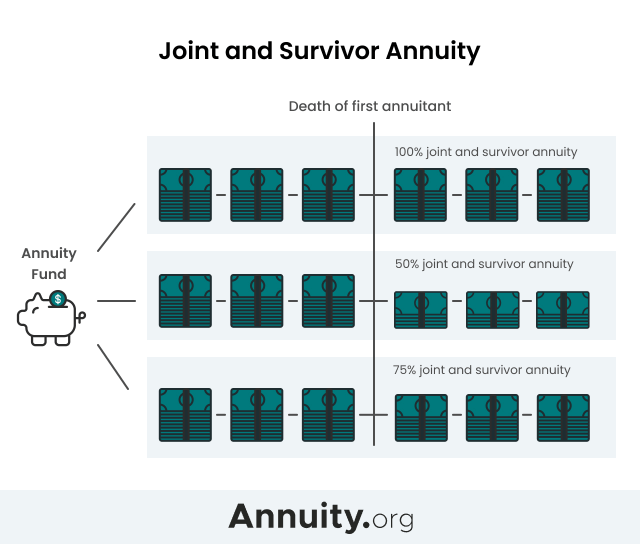

Joint And Survivor Annuity The Benefits And Disadvantages

Annuity Payout Options Immediate Vs Deferred Annuities

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Life Insurance Over 70 How To Find The Right Coverage Life Insurance Quotes Term Life Insurance Quotes Term Life

Straight Line Depreciation Formula Guide To Calculate Depreciation

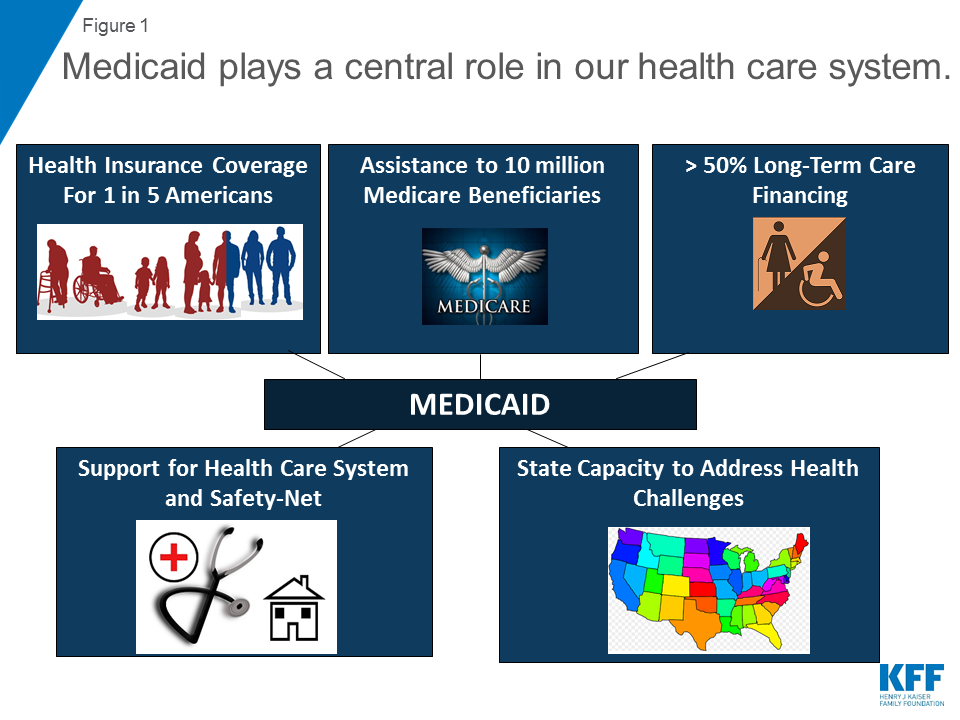

10 Things To Know About Medicaid Setting The Facts Straight Kff

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)